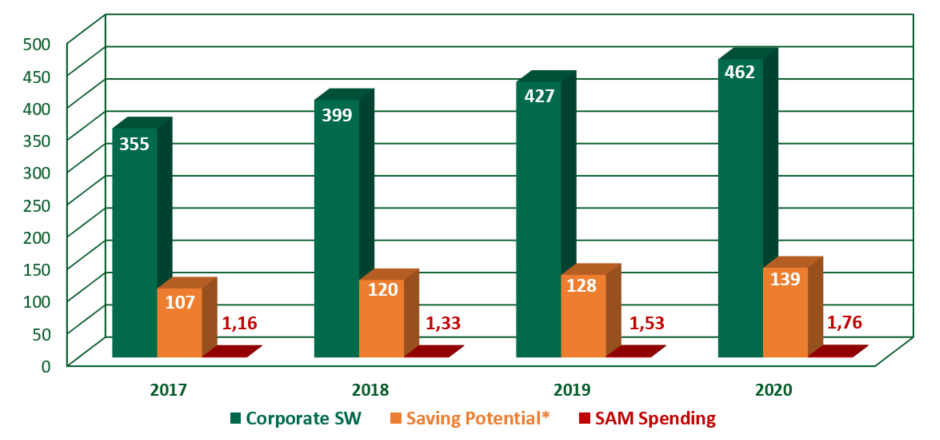

?Worldwide IT spending is projected to total $3.79 trillion in 2019, an increase of 1.1 percent from 2018?, according to the latest forecast by Gartner, Inc in April 2019. ?The shift of enterprise IT spending from traditional (noncloud) offerings to new, cloud-based alternatives is continuing to drive growth in the enterprise software market. In 2019, the market is forecast to reach $427 billion, up 7.1 percent from $399 billion in 2018.?

Another research available on Research And Markets states that ?the software asset management market size is expected to grow from USD 1.16 billion in 2017 to USD 2.32 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 14.8% during the forecast period. The increasing need to manage the life cycle of assets and compliance-readiness are expected to be driving the software asset management market. The lack of awareness of the software asset management solutions and services among the Small and Medium-sized enterprises (SMEs) and budget constraints are expected to be the major restraining factors for the growth of the market.?

Let?s assess a table comparing the figures the above-mentioned reports, and keeping in mind the often cited Gartner statement: ?You can preserve 30% of your IT spendings with proper software asset management?:

Worldwide SAM spending represents less than 0.5 percent compared to the total enterprise software market, while proper software asset management could save a significantly higher proportion of the software budgets of enterprises. Based on our Central European project experiences, the situation is very similar to the total picture in this region, too.

Among the key driving forces to implement SAM, cost saving is probably the most implicit one, yet figures above suggest that most enterprise CxO?s are still reluctant to incorporate the SAM approach, tools, and processes into the comprehensive corporate strategy ? or at least, into the IT strategy. Of course, the knowledge of the relevant IT, accountancy and legal aspects and understanding their interrelations are all necessary in order to manage complex SAM projects properly. Also, assembling and improving this knowledge is usually not economical within a company. But an independent licensing consultant partner has proper industry experience, expertise, and SAM tools to cover the complete enterprise SAM process. Thus, by optimizing the software portfolio of the company according to real business needs, and also optimizing licensing models, the significant cost saving is achievable.

It quickly becomes clear that SAM should not be regarded as a cost but as a quick-return investment. So, it is not worth saving on SAM, but it is worth saving on enterprise software costs ? with the help of SAM.